Need for an ecosystem that aligns financial mechanisms to achieve SDGs

image for illustrative purpose

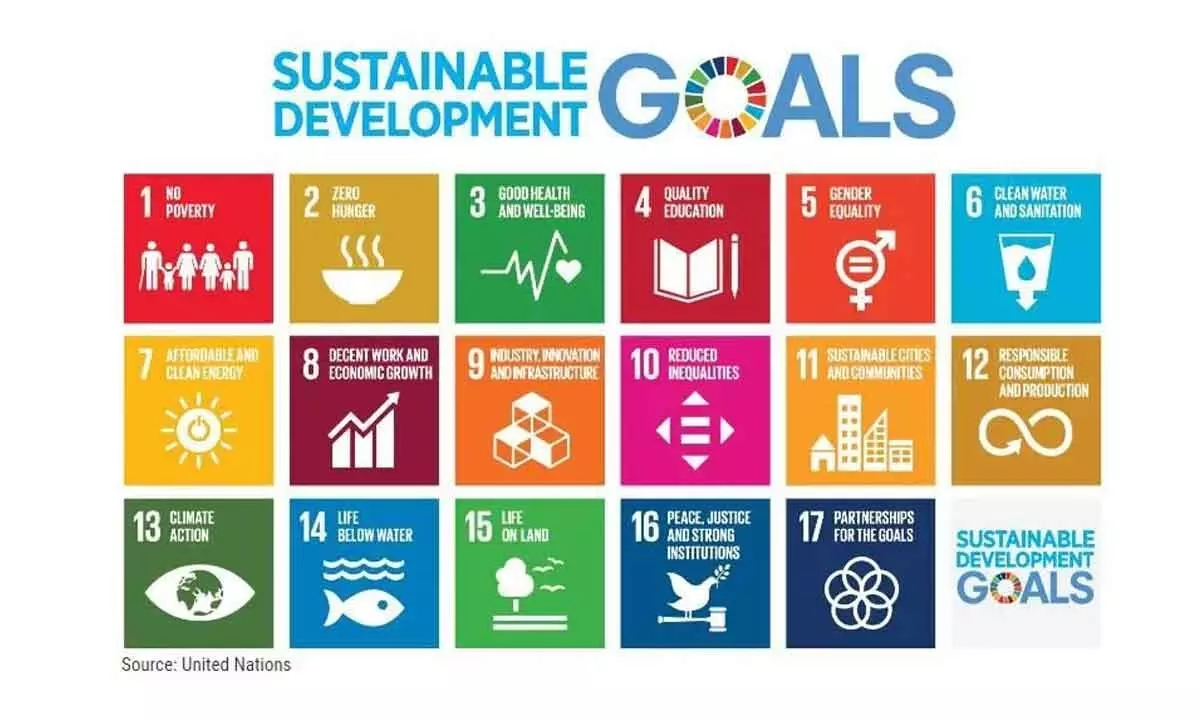

There is a critical role of innovative financial instruments in financing and mobilizing resources for green infrastructure. There is no doubt whatsoever that the power of GSS bonds (Green, Social, and Sustainability Bonds) to forge a sustainable future for our markets and society needs to be leveraged. What is needed is to bridge the climate financing gap in India and GSS bonds are emerging as an important tool. The concerned authorities have realised that addressing the pressing climate change is paramount and this calls for a robust embrace of GSS-linked financial instruments to effectively navigate this landscape. Besides, with GIFT IFSCA at the forefront, India is not merely committing itself to a greener future but is also leading the charge towards achieving it on a global scale, which makes clear the significance of GSS Bonds. Integration of GSS principles within the financing mechanisms for ULBs and other government utilities and infrastructural programmes is a strategic move and also imperative for sustainable urban development. There is an urgent need to harness research, integrated planning and strategic partnerships to bolster the government's efforts in policy reforms and sustainable development. This can help achieve the Sustainable Development Goals (SDGs). Coming in handy towards this are IFC, Climate Bonds Initiative and the NSE approach.

Even GSS instruments are fast emerging as beacons guiding the urban transformation towards sustainability. With the introduction of Green Bond for Surat, for instance, the authorities aim to not only champion sustainable urban development but also set a precedent for municipalities across the country, demonstrating the effective use of financial markets for the betterment of society and the environment. Significantly, as a global issuer of GSS bonds, and a long-term investor in India, IFC is already committed to catalyzing the country’s sustainable finance market. The endeavour is to engage the issuers and the larger ecosystem in order to expand the reach and impact of GSS bonds and other financial instruments to channel greater investment towards initiatives that yield positive outcomes amid escalating climate challenges. Together with NSE, they are in the process of promoting thematic bonds and supplementing their ongoing efforts to advance the sustainable finance sector. Hence, the collaboration between NSE, IFC, and Climate Bonds Initiative signals a positive stride towards empowering market stakeholders with the required knowledge and tools to navigate the realm of Green, Social, and Sustainability bonds.

These initiatives serve not only as educational platforms but also as catalysts for collective action, fostering partnerships essential for steering our financial ecosystem towards a greener and more resilient future. With India standing on the brink of a sustainability-focused financial revolution, bids to promote and create awareness about GSS Bonds marks a critical step towards closing India's climate financing gap. This is a clarion call to leaders and visionaries to harness the transformative power of GSS bonds, especially as a cohesive team. There is a need to pave the way for a future where sustainability is interwoven with investment, which can create a robust ecosystem that aligns financial mechanisms with our shared environmental and social goals, propelling India towards its net-zero ambitions. One must not forget the need for integrating sustainability into the fabric of financial markets and contributing to a greener and a more resilient economy.